Every year, thousands of homeowners face the devastating reality of denied home insurance claims in Sydney. According to Allianz Australia’s 2025 Home Care Report, burst pipes alone resulted in over 19,000 claims in 2024, with a staggering 40% of Australian homeowners admitting they neglect regular home maintenance. But here’s the shocking truth: many of these expensive claims could have been completely avoided with simple preventive maintenance.

If you’re a Sydney homeowner, understanding the difference between covered “sudden and accidental” damage versus excluded “gradual damage” could save you tens of thousands of dollars. Insurance companies are increasingly denying claims they classify as preventable—resulting from poor maintenance, gradual deterioration, or neglect.

In this comprehensive guide, WSG Group’s 70+ years of experience serving Sydney and the Central Coast reveals exactly which plumbing, electrical, and roofing issues trigger insurance claim denials, how to prevent them, and what documentation you need to protect your coverage when emergencies strike.

Understanding Home Insurance Claims in Sydney: What Is Covered vs. What Is Denied

Home insurance policies in Australia are designed to protect homeowners from sudden, unexpected disasters—not gradual neglect. The critical distinction that determines whether your claim gets approved or denied hinges on these two categories:

Sudden and Accidental Damage (COVERED):

Insurance companies typically cover damage that occurs unexpectedly and without warning. Examples include:

- Burst pipes from sudden freezing or excessive pressure

- Electrical fires caused by appliance malfunction

- Storm damage to roofs from severe weather events

- Water damage from a suddenly failed hot water system

- Accidental damage during covered events

Gradual Damage and Neglect (NOT COVERED):

Most Australian insurance policies explicitly exclude damage resulting from lack of maintenance, gradual deterioration, or preventable issues:

- Slow leaks from aging plumbing that develop over months

- Roof leaks from deteriorated flashing or missing tiles

- Electrical faults from outdated, unmaintained wiring

- Mold and water damage from ongoing seepage

- Foundation damage from long-term drainage problems

- Corrosion and rust from deferred maintenance

The Insurance Industry Reality:

According to the National Association of Insurance Commissioners (NAIC), approximately 10% of property insurance claims are denied annually in developed markets. In Australia, Allianz’s research reveals that 40% of homeowners who take a “set and forget” approach to maintenance put their properties at significant risk of claim denial.

Insurance adjusters are trained to identify maintenance neglect. When they investigate your claim, they’ll look for evidence that the damage was preventable through regular maintenance. Without documentation proving routine inspections and upkeep, your claim could be rejected—leaving you responsible for repair costs that can easily reach $10,000 to $50,000 or more.

The Most Common Preventable Home Insurance Claims in Sydney

1. Plumbing-Related Insurance Claims (and How to Prevent Denial)

Plumbing issues represent the #1 category of preventable home insurance claims across Australia. While sudden burst pipes are typically covered, gradual leaks and water damage from poor maintenance are consistently denied.

Burst Pipes vs. Slow Leaks: The Insurance Distinction

A burst pipe that suddenly ruptures due to freezing temperatures or unexpected pressure is generally covered. However, a corroded pipe that slowly leaks over weeks or months—causing water damage, mold, and structural issues—will likely be denied as “gradual damage.”

Common Plumbing Issues That Trigger Claim Denials:

- Corroded or aging pipes: Old galvanized pipes, outdated plumbing systems showing rust or deterioration

- Slow-dripping taps and fixtures: Minor leaks that worsen over time, causing water damage

- Leaking toilet seals: Gradual water seepage damaging flooring and subfloors

- Faulty hot water systems: Slow leaks from aging tanks, sediment buildup causing failures

- Blocked drains and overflows: Tree root intrusion, grease buildup causing recurring backups

- Slab leak detection failures: Hidden leaks beneath concrete foundations going undetected

Prevention Steps That Protect Your Insurance Coverage:

To ensure your plumbing-related claims are approved, Sydney homeowners must demonstrate proactive maintenance:

- Schedule annual plumbing inspections with licensed professionals like WSG Group

- Document all repairs, replacements, and maintenance with dated invoices

- Address minor leaks immediately—don’t wait for them to worsen

- Replace aging hot water systems before failure (typical lifespan: 8-12 years)

- Install leak detection devices and water shut-off systems

- Keep gutters clear to prevent water overflow and drainage issues

- Photograph your plumbing systems and maintain a maintenance log

2. Electrical System Failures and Fire Risk Claims

Electrical faults are among the most dangerous and costly home insurance claims. While sudden electrical fires from appliance malfunctions may be covered, fires resulting from faulty wiring, overloaded circuits, or deferred electrical maintenance are frequently denied.

The Electrical Claim Denial Reality:

Insurance investigators will examine your electrical system’s condition. If they find evidence of:

- Outdated wiring (aluminum, knob-and-tube, or pre-1980s installations)

- Overloaded circuits without proper upgrades

- Missing or non-functional safety switches (RCDs)

- DIY electrical work not performed by licensed electricians

- Lack of electrical compliance certificates

- Ignored warning signs (flickering lights, burning smells, frequent breaker trips)

…your claim will likely be denied based on negligence or inadequate maintenance.

Common Electrical Issues That Lead to Claim Denials:

- Electrical fires from old wiring: Deteriorated insulation, exposed wires causing short circuits

- Switchboard failures: Outdated fuse boxes unable to handle modern electrical loads

- Faulty safety switches: Non-functional RCDs failing to prevent electrocution or fire

- Power surge damage: Lack of surge protection causing appliance damage

- Overloaded powerpoints: Extension cords and adaptors creating fire hazards

- Ceiling fan and lighting failures: Loose connections causing sparking and fire risk

Prevention Steps That Protect Your Insurance Coverage:

- Hire licensed electricians (like WSG Group) for all electrical work—never DIY

- Upgrade outdated switchboards to modern safety standards

- Install and test safety switches (RCDs) every 3-6 months

- Schedule electrical safety inspections every 5-10 years (or sooner for older homes)

- Document all electrical upgrades, repairs, and compliance certificates

- Replace old wiring in homes built before 1980

- Install whole-house surge protection systems

- Address warning signs immediately (burning smells, sparking, frequent trips)

3. Roofing Damage and Leak-Related Insurance Claims

Roofing claims are particularly contentious in the insurance world. Storm damage from severe weather events is typically covered, but roof leaks resulting from poor maintenance, aging materials, or gradual deterioration are routinely denied.

Storm Damage vs. Maintenance Neglect:

After a major storm in Sydney, your roof may develop leaks. Insurance adjusters will investigate whether the damage was caused by the storm (covered) or by pre-existing issues like missing tiles, deteriorated flashing, or clogged gutters (not covered).

Common Roofing Issues That Trigger Claim Denials:

- Aging roof materials: Tiles, metal sheets, or shingles past their expected lifespan (20-30 years)

- Deteriorated roof flashing: Cracked or missing flashing allowing water infiltration

- Clogged gutters and downpipes: Water overflow causing fascia rot and interior damage

- Missing or damaged roof tiles: Gradual tile loss exposing underlayment to weather

- Poor roof ventilation: Condensation buildup leading to mold and structural damage

- Tree damage from overhanging branches: Preventable damage from unmaintained vegetation

Prevention Steps That Protect Your Insurance Coverage:

- Schedule professional roof inspections annually (especially before storm season)

- Clean gutters and downpipes at least twice yearly (more often with nearby trees)

- Replace damaged or missing tiles immediately

- Repair deteriorated flashing and sealants proactively

- Trim overhanging tree branches to prevent storm damage

- Document all roof maintenance, repairs, and inspections with photos and invoices

- Consider roof replacement when materials reach 70-80% of expected lifespan

- Install gutter guards to reduce maintenance frequency

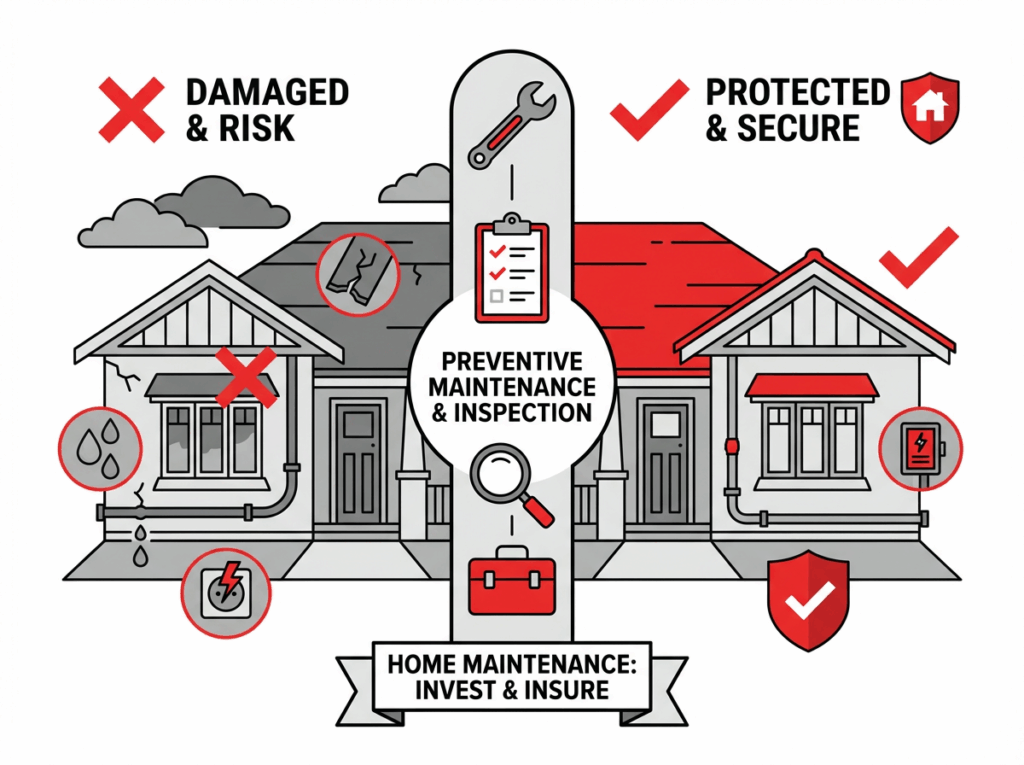

Preventable home insurance claims comparison damaged home versus protected home with WSG Group maintenance plumbing electrical roofing Sydney

How Insurance Companies Determine Preventable vs. Covered Damage

When you file a home insurance claim in Sydney, the insurance company sends an adjuster to assess the damage. Their job is to determine whether the damage qualifies as a covered event or falls under policy exclusions.

What Insurance Adjusters Look For:

Insurance investigators are trained to identify signs of maintenance neglect. During their inspection, they will examine:

- Age and condition of systems: Are plumbing, electrical, and roofing systems past their expected lifespan?

- Maintenance records: Can you provide documentation of regular inspections and repairs?

- Warning signs ignored: Were there visible signs of problems (leaks, cracks, electrical issues) that were not addressed?

- Compliance with standards: Does your property meet current Australian building and safety codes?

- Photographic evidence: Do photos show gradual deterioration rather than sudden damage?

- Professional assessments: Were licensed professionals used for all repairs and maintenance?

The Documentation That Protects Your Claims:

To successfully defend your insurance claim, you need a clear paper trail demonstrating proactive maintenance:

- Maintenance logs: Dated records of all inspections, repairs, and replacements

- Professional invoices: Receipts from licensed plumbers, electricians, and roofers

- Inspection reports: Annual assessments from qualified professionals

- Photographs: Before-and-after images showing system condition

- Compliance certificates: Electrical safety certificates, plumbing compliance, roofing warranties

- Warranty documents: Proof of recent system installations or upgrades

- Communication records: Emails or messages showing you reported issues promptly

Why January 2026 Is the Perfect Time for Preventive Home Maintenance

As Sydney homeowners enter 2026, now is the ideal time to address preventive maintenance that protects your insurance coverage. Here is why:

1. Post-Holiday Assessment Period

After the busy holiday season, January provides an opportunity to assess any damage from summer storms, increased usage, and holiday-related stress on home systems.

2. Storm Season Preparation

Sydney’s peak storm season runs from December through March. January inspections allow you to identify and fix vulnerabilities before severe weather strikes.

3. Insurance Policy Renewals

Many homeowners receive insurance renewal notices in January. This is the perfect time to review your coverage, understand exclusions, and ensure your property meets policy requirements.

4. New Year Maintenance Budgeting

With new financial years and budgets, January is when homeowners typically plan major home improvements and maintenance expenditures.

5. Avoid the Rush

Booking preventive inspections in January means avoiding the rush that follows storm damage, ensuring faster service and competitive pricing.

The WSG Group January 2026 Maintenance Checklist:

- Schedule comprehensive plumbing inspection (pipes, fixtures, hot water system)

- Book electrical safety check (switchboard, wiring, safety switches)

- Arrange professional roof inspection (tiles, flashing, gutters, downpipes)

- Document current condition with photographs

- Review and organize existing maintenance records

- Update insurance policy documentation

- Address any deferred maintenance immediately

- Create a 2026 maintenance schedule

The True Cost of Denied Insurance Claims: A Sydney Case Study

Real-World Example: The $45,000 Water Damage Claim That Was Denied

In 2024, a Sydney homeowner in the Inner West discovered extensive water damage affecting two bedrooms, a bathroom, and the living room ceiling. The damage appeared suddenly after heavy rainfall, and the homeowner immediately filed an insurance claim expecting full coverage.

The Insurance Investigation Revealed:

– The roof was 22 years old with visible missing tiles

– Gutters were completely clogged with years of debris buildup

– Interior water stains showed evidence of previous, unreported leaks

– No maintenance records or professional inspections existed

– The homeowner admitted they “had not had the roof checked in years”

The Result: Complete claim denial citing “gradual damage resulting from lack of maintenance.”

The Financial Impact:

– Denied claim value: $45,000

– Out-of-pocket roof replacement: $18,000

– Interior restoration and mold remediation: $22,000

– Structural repairs: $8,000

– Total homeowner cost: $48,000

What Could Have Been Different:

If the homeowner had invested in:

– Annual roof inspections: $200-300/year

– Gutter cleaning twice yearly: $150-250/year

– Professional maintenance documentation: Priceless

Total preventive investment over 5 years: approximately $2,500

Actual out-of-pocket cost after denial: $48,000

This real-world example demonstrates how a small investment in preventive maintenance and documentation could have saved over $45,000 in denied claims.

How WSG Group Protects Sydney Homeowners from Insurance Claim Denials

With over 70 years of experience serving Sydney and the Central Coast, WSG Group understands exactly what insurance companies look for when assessing claims. Our comprehensive maintenance services are specifically designed to protect your insurance coverage while keeping your home safe and functional.

Our Insurance-Protection Service Package Includes:

1. Comprehensive Property Inspections

Our licensed professionals conduct thorough assessments of your plumbing, electrical, and roofing systems, identifying potential issues before they become insurance-denial problems.

2. Detailed Documentation

Every inspection, repair, and maintenance service includes comprehensive documentation:

– Detailed inspection reports with photographs

– Professional invoices with scope of work

– Compliance certificates where required

– Maintenance recommendations with timelines

– Digital records accessible anytime

3. Preventive Maintenance Programs

We offer scheduled maintenance programs that ensure your home systems receive regular attention:

– Annual plumbing system checks

– Electrical safety inspections every 5-10 years

– Bi-annual roof and gutter assessments

– Hot water system servicing

– Emergency response available 24/7

4. Expert Repairs Using Quality Materials

When repairs are needed, WSG Group uses industry-leading materials and techniques that meet or exceed Australian standards, ensuring long-lasting results that satisfy insurance requirements.

5. Insurance Claim Support

If you do experience a sudden emergency, our documentation and professional assessments provide the evidence insurance adjusters need to approve your claim quickly.

Why Sydney Homeowners Trust WSG Group:

- Fully licensed and insured professionals in plumbing, electrical, and roofing

- Free onsite inspections with transparent, upfront pricing

- 24/7 emergency service for sudden issues across Sydney and Central Coast

- Lifetime warranty on workmanship for peace of mind

- 70+ years of local experience understanding Sydney’s unique climate challenges

- Insurance-friendly documentation that satisfies claim requirements

- Same-day service availability for urgent repairs

- Top-rated customer service with hundreds of 5-star reviews

Frequently Asked Questions: Home Insurance Claims and Preventive Maintenance

Q1: Does home insurance cover plumbing problems in Sydney?

A: Home insurance typically covers sudden and accidental plumbing damage, such as burst pipes from unexpected freezing or pressure. However, it does NOT cover gradual damage from slow leaks, corroded pipes, or lack of maintenance. To ensure coverage, homeowners must demonstrate regular maintenance and prompt repairs of minor issues.

Q2: What is considered gradual damage that insurance will not cover?

A: Gradual damage refers to deterioration that occurs slowly over time due to aging, wear and tear, or lack of maintenance. Examples include: slow-dripping pipes causing water damage over months, roof leaks from deteriorated flashing, electrical faults from unmaintained wiring, and mold growth from ongoing seepage. Insurance companies consider these preventable through proper maintenance.

Q3: How often should I have my plumbing, electrical, and roofing systems inspected?

A: Industry best practices recommend: Plumbing systems – Annual inspections, especially for homes over 15 years old. Electrical systems – Every 5-10 years, or sooner if you experience issues. Roofing systems – Annual inspections, with additional checks after severe storms. Hot water systems – Annual servicing, with replacement every 8-12 years. Gutters and downpipes – Cleaning twice yearly (more often with nearby trees).

Q4: What documentation do I need to prove maintenance to my insurance company?

A: Keep comprehensive records including: dated invoices from licensed professionals, inspection reports with photographs, compliance certificates for electrical and plumbing work, warranties from system installations, maintenance logs showing regular servicing, and before-and-after photos of repairs. Store these documents digitally and provide copies to your insurer upon request.

Q5: Can a denied insurance claim be appealed?

A: Yes, denied claims can be appealed, but success depends on evidence. If you can demonstrate that: the damage was sudden and accidental (not gradual), you maintained regular professional inspections and repairs, you have documentation proving proactive maintenance, and the damage falls within policy coverage—you may successfully appeal. Consider consulting with an insurance dispute resolution specialist if needed.

Q6: Does WSG Group provide documentation suitable for insurance claims?

A: Absolutely. WSG Group provides comprehensive documentation with every service, including: detailed inspection reports, professional invoices with scope of work, compliance certificates where applicable, photographic evidence, and maintenance recommendations. This documentation is specifically designed to satisfy insurance company requirements and support claim approvals.

Conclusion: Protect Your Sydney Home and Your Insurance Coverage Today

The reality is clear: preventable home maintenance issues are the number one reason insurance claims are denied in Australia. With 40% of homeowners admitting to maintenance neglect and insurance companies increasingly scrutinizing claims, Sydney homeowners cannot afford to take a “set and forget” approach.

The difference between a $45,000 approved claim and a complete denial often comes down to one simple factor: documented, professional preventive maintenance.

As you enter 2026, now is the perfect time to:

✓ Schedule comprehensive plumbing, electrical, and roofing inspections

✓ Address deferred maintenance issues immediately

✓ Create a documentation system for all home maintenance

✓ Partner with trusted professionals who understand insurance requirements

Do not wait until disaster strikes to discover your claim will be denied.

WSG Group has protected Sydney and Central Coast homes for over 70 years with expert plumbing, electrical, and roofing services designed to keep your property safe, functional, and fully insured. Our comprehensive inspections, quality repairs, and insurance-friendly documentation ensure you are never left holding the bill for a denied claim.

Take Action Now: Your Free Home Insurance Protection Inspection

Contact WSG Group today for a complimentary onsite inspection that includes:

• Comprehensive assessment of plumbing, electrical, and roofing systems

• Identification of potential insurance-denial risk factors

• Detailed documentation with photographs

• Transparent pricing for recommended repairs

• Priority scheduling for urgent issues

• 24/7 emergency service availability

Call 1800 186 597.

Protect your home. Protect your insurance coverage. Partner with WSG Group—Sydney’s trusted experts since 1947.